Hyperinflation is that transition period when a paper money is clearly failing as a store of value but has not yet died as a medium of exchange. This blog is to look at this and any other interesting economic issues. Vincent Cate

Tuesday, December 30, 2014

8 to 12 trillion new Yen per month? Stick a fork in it.

On Dec 30th the Bank of Japan announced that it will start making 8 to 12 trillion new Yen per month. To get an idea of the scale of this, the Government of Japan averages less than 5 trillion per month in taxes collected.

On Apr 4th 2013 the BOJ announced it would double the monetary base in 2 years. This came to around 50-70 trillion Yen per year for 2 years. The monetary base seemed to go up about 0.6% every 10 days.

However, as we started to near the end of the 2 year time period a new policy was announced on Oct 31st of 80 trillion Yen per year with no end date. This was 10 to 30 trillion Yen per year more than previously. The monetary base seemed to go up around 1% every 10 days.

If the Dec 30th rate stays fixed for the whole year, then multiplying by 12 gives a new yearly target of 96 to 144 trillion Yen. After the initial 2 year period is over, in Apr 2015, instead of stopping it now seems they will be printing about twice as fast. The monetary base should go up well over 1% every 10 days.

However, one familiar with how these things work, or able to spot a trend, should not expect a fixed 8 to 12 trillion Yen per month for the whole year but instead to see more increases in the rate of Yen printing. If you did not spot the trend, read the previous 3 paragraphs again. :-)

Thursday, December 25, 2014

No, Japan Cannot Stop Printing Yen

The official story is that Japan is printing like crazy just because they want more inflation and that they will stop when they get to 2% inflation. The story makes it seems like the government and central bank have things under control. Like they are making the markets do what they want. The vast majority of articles I read on the net seem to accept this official story as truth, but it is not true.

With 5 year bonds paying 0.03% interest, the rational investors are getting out of JGBs. The central bank is probably the only net buyer. The central bank is making about 80 trillion new Yen per year and buying bonds when total taxes collected are about 50 trillion yen per year. This is an enormous amount of new money.

They have been increasing the base money supply by around 1% every 10 day reporting period. You have to be a fool to buy bonds paying 0.03% interest per year in a currency where the base money supply is going up around 1% every 10 days.

If we average over the last 4 months, the Yen is losing around 1% per week compared to the dollar. You have to be a fool to buy a 5 year bond paying 0.03% interest in a currency losing about 1% per week.

The Japanese government is spending about twice what they get in taxes. Nobody likes spending cuts and nobody likes tax increases. Not enough voters or politicians will view this as a problem as long as they can print money for the difference. You have to be a fool to buy bonds in a country that spending twice what they get in taxes and running the printing presses to cover the difference.

However, if they let interest rates go up in an attempt to attract bond buyers the interest on the debt would be more than the taxes collected. This makes it clear they are going to have to print money and so the money that you get back when the bond comes due will not be worth as much as the money you bought the bond with. You would have to be a fool to buy bonds from a government where the interest on their debt was more than their total taxes.

Not only do you have to be a fool to buy JGBs, you have to be a fool to hold them or roll them over. So not only do they have to print Yen to cover the deficit, but also the bonds coming due. The government has previously issued bonds more than twice the total GNP and much of it is short term. As it comes due they have to pay the bond holders. The only way they can get money to pay previous bonds is by first selling a new bond, since taxes don't even cover spending. The only way they can sell a new bond is if the central bank prints Yen and buys the bond. Governments never default on debts in a currency they can print. They print.

Japan has entered a death spiral where the more people that get out of JGBs the more Yen they have to print but the more Yen they print, the more people get out of JGBs. This death spiral is a positive feedback loop that once started is very hard to stop.

Recently Krugman got in a limo with Abe and advised him to delay a tax increase and do more money printing (he would really have said "stimulus"). Krugman may soon wish he had not gotten his name attached to the mess that is coming.

Even at 120 Yen per dollar, we are talking trillions of dollars worth of bonds. Fools with money will hardly make a dent in this. The central bank will keep being the buyer of only resort. The central bank must keep printing no matter if it lets interest rates go up or if they keep interest rates down. They have past the point of no return. They can not stop at 2% inflation. Yen printing is out of control. It is no longer possible to halt it.

Saturday, December 20, 2014

Payment for Additional Hyperinflation Explanations

[[[This has ended]]]

I count 49 different explanations for hyperinflation in my collection as of Sat Dec 20th, 2014.

I think it is fun that there are so many different, yet reasonably, ways of thinking about how hyperinflation works. Given how many I have found so far, I am sure there must be more good explanations out there. If there are other economic theories with different explanations for hyperinflation I would really like to add them to my collection.

I have decided I will pay $30 by paypal or BitCoin to someone who comments here with a new explanation that in my judgement is different from any in the existing collection but is as good or better than the average explanation so far. It should fit the experimental evidence for at least many historical hyperinflations.

I am not looking for different reasons that governments spend more than they get in taxes and will not pay for such things. Saying "supply shock", "war", "corruption", "external debt", "drop in taxes", "incompetence", "madness", etc does not earn anything.

I am looking for more good theory for the mechanics of how hyperinflation works. The why, the how, the process of hyperinflation. See existing explanations for an idea of the type of thing I am looking for and to be sure you are not submitting something already in my collection.

Please forward this offer to anyone you think might be willing and able to submit an explanation.

This offer starts today, Dec 20, 2014. I can afford at least 10 new explanations and even 5 good explanations every month. I may reduce this offer for future submissions if they come much faster than that. If I don't get many I may up the offer and if so the increase in payment will also be retroactively extended to previous winners.

To submit an explanation just comment below. The full explanation must be in the comment but it is good to also include a link to a source if you have one.

Wednesday, December 17, 2014

This is Not Natural

For the last 3 months the Yen is losing on average around 1% per week:

Yet the yield on 2 year Japanese Government Bonds (JGBs) is negative. You have to pay the government to take your money. The 5 year yield is 0.05%. This means after 5 years you get a total of about 0.25% interest. This is about what the Yen loses in the average day recently.

They are printing at a rate of 80 trillion yen per year and buying mostly JGBs, much more than the total taxes collected. This has driven up JGB prices far into bubble territory. These yields are absolutely nuts. It is not natural. Only massive central bank money creation and bond buying makes these kinds of numbers possible. These are not free market rates. Sane people are not buying JGBs at these yields with the value of the Yen falling fast. The insane central bank must be the only buyer.

Bubbles always fail somehow. Since the Japanese government could not afford rational interest rates on their debt, I expect the central bank to keep interest rates down. However, to do this they have to make new Yen so fast that they will destroy the currency.

Yet the yield on 2 year Japanese Government Bonds (JGBs) is negative. You have to pay the government to take your money. The 5 year yield is 0.05%. This means after 5 years you get a total of about 0.25% interest. This is about what the Yen loses in the average day recently.

They are printing at a rate of 80 trillion yen per year and buying mostly JGBs, much more than the total taxes collected. This has driven up JGB prices far into bubble territory. These yields are absolutely nuts. It is not natural. Only massive central bank money creation and bond buying makes these kinds of numbers possible. These are not free market rates. Sane people are not buying JGBs at these yields with the value of the Yen falling fast. The insane central bank must be the only buyer.

Bubbles always fail somehow. Since the Japanese government could not afford rational interest rates on their debt, I expect the central bank to keep interest rates down. However, to do this they have to make new Yen so fast that they will destroy the currency.

Saturday, November 8, 2014

Greenspan on Inflation and Gold

Interesting recent interview with Greenspan. Some parts:

But the fact the fiat currency expansion got very tarnished with -- you know, in 1775, we printed a whole bushel full of continentals. And one of the fascinating things about that period is the fact, for the first year or two, there was very little evidence that that had any effect on prices, meaning that that paper currency circulated with the same value as specie.

And there is an extraordinary -- there's an extraordinary lag which exists between actions of that type and consequences. Now, eventually the continental was not worth a continental. But it took a long while. And I think that we're looking at very similar things now. This, again, is a human propensity.

The Continental currency had hyperinflation. It is interesting that Greenspan says, "I think that we're looking at very similar things now". He is directly talking about the long delay between printing money and high inflation, but it sure seems like he is hinting at high inflation this time too.

Greenspan also thinks gold is a good investment:

Tett: Do you think that gold is currently a good investment?

Greenspan: Yes... Remember what we're looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.

First Exchange Rate Drops Then Hyperinflation

In Weimar Germany the exchange rate adjusted well before inflation started.

In Zimbabwe the exchange rate collapsed 72% on November 14 1997. After that inflation really started picking up.

I believe the normal case for hyperinflation is that the exchange rate drops first and then the inflation picks up after. The exchange rate reacts quickly while the huge number of prices that make up inflation indexes take longer to adjust.

I expect that Japan will see the Yen exchange rate drop much more before they start getting high inflation.

Wednesday, November 5, 2014

2.6% in 11 days

From Oct 20 to Oct 31 the Central Bank of Japan increased their balance sheet and the base money supply by 2.6%. The last day of this period was their big announcement that they would be making 80 trillion yen per year. I wonder if the current 10 day period will be even higher, since all of these days will be after the big announcement. Will be very interesting to see the next report.

I don't expect the demand for Yen is going up as fast as the supply. In fact, with all this printing I would expect the demand to go down.

I don't expect the demand for Yen is going up as fast as the supply. In fact, with all this printing I would expect the demand to go down.

Saturday, November 1, 2014

Impending Shortage of JGB Fools

As a central bank drives up bond prices investors can make money holding bonds, even at low interest rates. However, at some point the prices get so high and interest rates so low that you really need a greater fool to buy them. Currently the interest on 10 year JGBs is less than 0.5% per year. The Yen was down more than 3% for part of the day yesterday and closed down 2.7%. It takes 6 years of interest at 0.5% to make up for a 3% loss in the currency. However, there will be many more losses over the next 6 years, so investors will never catch up. At this time there is no greater fool than someone holding 10 year JGBs, except someone holding 30 year JGBs. There will soon be an acute shortage of these JGB fools.

The normal method to get more people to hold bonds in a currency is for the central bank to let interest rates go up. This past week Russia let interest rates go up to try to make holding their bonds more attractive to the market.

However, Japan is in such a bad situation that this normal method will not work. The government is spending about twice what they get in taxes, a problem almost impossible to fix. The yearly taxes were 47 trillion Yen and the central bank is now monetizing at a rate of 80 trillion per year. The total Japanese government debt is over 1 quadrillion yen (1000 trillion yen). Money printing is much more than taxes and more than the deficit. The central bank is effectively funding the deficit and about that much again buying up bonds from the rest of the market, which on net is reducing bond holdings. Even the pension funds are now getting out of JGBs. The Japanese government debt is so high that if interest rates go up to about 4.7%, just paying the interest on the debt will use up all the money collected from taxes. Rates in Japan were this high in 1991. If people don't want to buy JGBs now, they won't want to buy them when all of government taxes just cover the interest on the debt. This is not an attractive situation to bond holders. Half this rate would mean half of taxes just to pay interest, twice this rate would mean interest twice taxes. Neither of these is attractive to bond investors either. The normal method of raising interest rates to improve demand for bonds will not work for JGBs. There is no interest rate that increases demand so the central bank is not forced to monetize even more than the total deficit at this point. This is a big problem, the central bank is effectively forced to print money with no way out.

When the central bank of Japan announced the increased rate of monetization they claimed it was because they are worried that lower oil prices are pushing Japan toward deflation, so they want to push harder toward inflation. I think the real reason is nobody else is buying JGBs and people are selling, so the central bank needs to buy even faster. Also, when they announced the first huge printing it was to double the money supply in 2 years. This had the implication that they would stop. Now they are saying they are printing at a rate of 80 trillion yen per year, which does not imply any ending.

At this point the Japanese Central Bank is really funding Japan's government deficit, with no way to stop. I think the market is starting to realize this and that is why people are starting to flee JGBs. Soon, if not already, there will be a death spiral where the more the central bank monetizes, the less people want to hold JGBs and the less people hold JGBs the more the central bank is forced to monetize. The only alternative is for the central bank to let the government fail, which never happens. This death spiral has many characteristics in common with positive feedback loops in nature, which tend to end in destruction. In this positive feedback loop, which also include higher velocity of money and loss of confidence, the end is the destruction of the currency.

Keynesians live in fear of a deflationary spiral, which in practice almost never happens and when it does is usually slight. They are now acting like anything less than 2% inflation is deflation, just so they have some real world examples to panic about. However, they can't seem to imagine or understand a high inflation death spiral, which happens rather often to fiat money and is a much greater danger. They need to study up on the theory of hyperinflation death spirals.

Mark my words, there will soon be a horrible shortage of JGB fools.

Monday, October 20, 2014

BIS Fears Bond Panic

In a BIS report by Guy Debelle there are warnings of the risk of a bond panic. A few interesting parts extracted below:

When volatility returns, for a number of reasons, including those I have already mentioned, it may well rise quite rapidly.

But if we look back at previous market sell-offs, when market-making capacity was larger, we see that they were often quite violent too.

There are a few other reasons to suspect that the sell-off, particularly in fixed income, could be relatively violent when it comes.

But there are probably a sizeable number of investors who are presuming they can exit their positions ahead of any sell-off. History tells us that this is generally not a successful strategy. The exits tend to get jammed unexpectedly and rapidly.

Another reason to suspect that the sell-off might be violent is the starting point, namely zero nominal interest rates. That is a point we haven’t started from before (with the possible exception of Japan).

So there is a fair chance that volatility will feed on itself. One should always be careful of looking for too much rationality in trying to understand market dynamics. Given the lack of rational arguments for the current state of affairs, trying to rationally explain how it will unwind is also going to be difficult.

So in conclusion, there are a number of anomalies present in financial markets in terms of pricing and volatility. There are also some misplaced perceptions amongst market participants about the degree of liquidity present in some market segments. That strikes me as a dangerous combination and unlikely to be resolved smoothly.I also think a bond panic will feed on itself. I think the end result will be that the central bank makes lots of new money and buys up lots of bonds, and the value of the currency goes down.

Saturday, October 4, 2014

Noah says Japan Will Monetize Debt

Noah Smith wrote Japan's Debt Trap where he concludes that Japan will monetize their debt. On this point I believe he is correct, Japan will monetize their debt. However, he says a few other things I do not agree with.

Noah:

Noah:

He should be worried. Hyperinflation destroys an economy. It is not just an accounting exercise. I suspect he need to read my CMMT article.

Noah:

Noah:

But if inflation strikes, it could rise high enough to hurt growth, and therefore tax revenue, severely. That would mean game over -- Japan’s government would be forced to default (or to hyperinflate, which amounts to a messier version of the same thing).Defaulting would not really help because much of the debt is owed to their retired voters. The government would still end up having to take care of these people, so it would not save that much. After defaulting the government would still be spending nearly twice what they get in taxes but now the central bank would be the only bond buyer for sure. With the central bank clearly monetizing their deficit, they would get hyperinflation even after defaulting. Default in Japan would not avoid hyperinflation. Yes, hyperinflation amounts to a messier version of default.

Noah:

But I’m not worried. In the end, a sovereign default is just an accounting exercise -- marking down the assets of some Japanese people and marking up the assets of others.

He should be worried. Hyperinflation destroys an economy. It is not just an accounting exercise. I suspect he need to read my CMMT article.

Noah:

The fact is, no one really knows what causes high-inflation episodes to begin.I really think I understand and can explain how high inflation episodes work. In fact, I have a model with which I can simulate how high inflation quickly begins. It is true that predicting the exact start time of a positive feedback phenomenon is not really possible. However, we can tell Japan has a high risk of a hyperinflation chain reaction at any time now.

Saturday, September 27, 2014

Lenin and planned hyperinflation

Gary North quotes Keynes and someone who says they got some notes from someone who interviewed Lenin. Part of it is:

Hundreds of thousands of rouble notes are being issued daily by our treasury. This is done, not in order to fill the coffers of the State with practically worthless paper, but with the deliberate intention of destroying the value of money as a means of payment. There is no justification for the existence of money in the Bolshevik state, where the necessities of life shall be paid for by work alone.Assuming this quote is correct, my bet is that after the currency was "practically worthless paper" Lenin was trying to pretend that it was planned so that it looks like central planning works. If he admitted that he did not want his money to be worthless it would seem central planning was a failure. Lenin needed to seem in control.

In another quote Keynes says:

The "might have done from design" seems to indicate Keynes had some skepticism about the claim that Lenin did it on purpose.

In the latter stages of the war all the belligerent governments practiced, from necessity or incompetence, what a Bolshevist might have done from design.

This is the only case of hyperinflation I have found where there is any claim that the hyperinflation was intentional. I just don't buy it. I suspect this case was just like all the others, the market reacting after government had too much debt and deficit and out of control money printing.

Saturday, September 13, 2014

Central Banks Jump The Shark

There was an episode of Happy Days where Fonzie jumped over a shark on water skis. Since then the idiom Jumping the Shark has come to mean when the creators of a show have run out of good ideas.

Japan's central bank has made negative interest rates and also Europe’s central bank has made negative interest rates. This means they have run out of good ideas. These central banks have jumped the shark. From here on the quality will go downhill. It will not be fun any more.

Wednesday, September 10, 2014

Japanese Yen Heading For Hyperinflation

The Yen is down more than 4% in the last month against the dollar.

The 10 year Japanese Government Bonds (JGBs) pay 0.54%. So losing 4% in value is about like losing 8 years worth of Interest. If you can lose 8 years worth of reward in one month, the risk and the rewards are way out of whack.

The demand for JGBs is very low. Many of the buyers are really just front running the central bank. The central bank has driven some rates below zero. Investors and traders are happy to hold bonds while interest rates are going down because the value of the bonds goes up. With interest rates below zero, it is time to get out.

In the Aug 31 report from the Central Bank of Japan, they had increased their balance sheet by 1.1% in the previous 10 day period. This is printing money at hyperinflationary rates.

I think Japan is falling into the grip of the positive feedback loops of hyperinflation. It does not make sense for investors to roll over JGBs. As people don't roll them over, the central bank becomes more and more the only buyer. But it is buying with newly made money which makes holding bonds an even worse investment. The more new money, the less people will want to hold JGBs or the Yen. But the less people hold, the more the central bank will make money to buy JGBs. Seems like the death spiral is starting to circle for the Yen.

A big part of the last month change is really that the US dollar has gone up. So one could argue that it is not the Yen going down but really the dollar up.

Right now Great Britian may be losing part of their tax base to independence. If Scotland leaves, Northern Ireland may follow. The Euro has gone even more crazy with printing money. So maybe it is that the Pound, Euro, and Yen are all going down and not that the dollar is really going up.

If an expert saw water coming through a gopher hole in an earth dam he could tell you for sure that the dam was going to fail very soon. Once the positive feedback loop for dam failure starts, it is just a matter of time. I wish I was such an expert that I could tell you for sure that the positive feedback loops for Yen hyperinflation have started, I really think so, but I can't tell you for sure.

Full disclosure: Author is short Yen.

Wednesday, September 3, 2014

Krugman's Missing Model

For years Krugman has been posting asking if anyone has a model of how a country that prints its own money can get into trouble from high government debt and deficit. Here is one quote, but there are many many others:

First let me quote Wikipedia about economic models, "In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified framework designed to illustrate complex processes, often but not always using mathematical techniques." Also, "A model establishes an argumentative framework for applying logic and mathematics that can be independently discussed and tested and that can be applied in various instances."

In my model of hyperinflation there are positive feedback loops. It is very similar to an avalanche, earthquake, volcano, or forest fire. Conditions build up that make a chain reaction possible. It is hard to predict when the chain reaction will start because some small thing triggers the chain reaction. After starting, the chain reaction happens relatively quickly and with impressive power. Once started, it is very hard to stop. Eventually it burns itself out.

There are many different ways to explain the positive feedback loops in hyperinflation. Different economic theories explain it differently. There are many good ways to think about hyperinflation. Here is just one sample from that link:

I also have an online simulation showing how hyperinflation works. It shows how hyperinflation emerges mechanically from macroeconomic processes gone wrong. This shows 5 different feedback loops with reasonable formulas can quickly go from normal inflation to high inflation. It uses things like "money supply", "inflation rate", "velocity of money", "interest rate", "GNP", etc. I think my model is closer to the reality of hyperinflation than any other I have seen. All the details of the model are well specified so that the computer can run the simulation. Anyone can easily change the inputs or even the formulas and see how it would change the results. They are invited to publish their version of the formulas for further argument/discussion. It is a good model for learning and thinking about how inflation spirals out of control in a country that can print its own money. This is the model Krugman has been searching for.

I have been unsuccessful in contacting Krugman. If you know how to contact him, please let him know I have the model he is looking for.

I find it quite remarkable that nobody has managed to produce a coherent model to justify the seemingly simple story that anyone, even a country that borrows in its own currency, can suddenly turn into Greece. Again, show me the model!I have the model he is looking for! Of course when you print your own money the exact failure mode from too much debt and deficit is a bit different but no less dangerous or bad.

First let me quote Wikipedia about economic models, "In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified framework designed to illustrate complex processes, often but not always using mathematical techniques." Also, "A model establishes an argumentative framework for applying logic and mathematics that can be independently discussed and tested and that can be applied in various instances."

In my model of hyperinflation there are positive feedback loops. It is very similar to an avalanche, earthquake, volcano, or forest fire. Conditions build up that make a chain reaction possible. It is hard to predict when the chain reaction will start because some small thing triggers the chain reaction. After starting, the chain reaction happens relatively quickly and with impressive power. Once started, it is very hard to stop. Eventually it burns itself out.

There are many different ways to explain the positive feedback loops in hyperinflation. Different economic theories explain it differently. There are many good ways to think about hyperinflation. Here is just one sample from that link:

There can be a feedback loop where the more the central bank makes money and buys bonds the less people want to hold bonds, but the less people hold bonds the more the central bank has to monetize so the government has cash to operate. This results in a flood of new money and inflation. The inflation causes the velocity of money to go up. Governments almost always try to fight inflation with price controls. The resulting shortages make the real GNP go down. Using the equation of exchange view of hyperinflation, we can see that if the money supply is going up fast, the velocity of money is going up fast, and GNP is going down, that prices will go up very fast. Hyperinflation is a triple whammy of inflation. Of course, the more inflation goes up, the more value bonds lose, so the less anyone wants to hold bonds...

I also have an online simulation showing how hyperinflation works. It shows how hyperinflation emerges mechanically from macroeconomic processes gone wrong. This shows 5 different feedback loops with reasonable formulas can quickly go from normal inflation to high inflation. It uses things like "money supply", "inflation rate", "velocity of money", "interest rate", "GNP", etc. I think my model is closer to the reality of hyperinflation than any other I have seen. All the details of the model are well specified so that the computer can run the simulation. Anyone can easily change the inputs or even the formulas and see how it would change the results. They are invited to publish their version of the formulas for further argument/discussion. It is a good model for learning and thinking about how inflation spirals out of control in a country that can print its own money. This is the model Krugman has been searching for.

I have been unsuccessful in contacting Krugman. If you know how to contact him, please let him know I have the model he is looking for.

Wednesday, August 27, 2014

Regression toward the mean / Pendulum swings back

Hussman has a very interesting graph.

We are currently at extremes never reached before. We should expect regression toward the mean or for the pendulum to swing back past the mean. We should not expect to stay at the current extreme levels for low interest rates or for high monetary base to NGDP ratio for a long time.

So how do we return to normal levels? With US deficit spending levels, and Yellen as Fed Chair, I don't think there is any real chance of reducing the monetary base. Over a long enough time, the real GNP might grow by a factor of 2 and bring us back to normal levels of monetary base to NGDP, but I don't think we have that much time before something happens. So what will happen? The easy way is for prices to go up so that NGDP goes up. That is what I expect. Prices going up.

Prices going up by a factor of 2 or 3 gets us near the mean for the above data. However, after such extremes, I think we should expect a pendulum swinging to extremes at the other end of the graph. So prices should go up well over a factor of 3 and we should have high interest rates.

Monday, August 25, 2014

Kuroda Warns JGBs will drop in value this fiscal year

In Jackson Hole, Kuroda said:

Mr. Kuroda vowed to maintain Japan’s aggressive monetary-policy easing until the country reaches its 2% inflation target, which he said could happen as early as this fiscal year.If interest rates are going up then bond prices are going down.

Mr. Kuroda said that once inflation starts moving higher, 10-year government bond rates around 0.5% will not be sustainable.

I think Japan is primed for hyperinflation and just needs some kind of spark to light the positive feedback loop. Bonds dropping could be the thing to get the ball rolling. People don''t like to hold bonds that are dropping in value. The more people who sell the more they will drop in value. So we could set off the feedback loop. In fact, just the central bank chief saying bonds will be dropping might even be enough of a trigger.

Saturday, August 16, 2014

Positive Feedback Theory of Hyperinflation

I contend that Hyperinflation is a set of Positive Feedback loops. There are many different ways to describe these loops. One is that after a government has a large debt and a large deficit that it can get into a loop where the more people stop rolling over their bonds the more the central bank has to make new money and buy bonds, so the government has cash to operate. But the more new money it makes the more inflation there is and the less anyone wants to hold bonds. So the phenomenon can feed on itself and grow. There are more loops, but this gives you one way of explaining one part of hyperinflation.

In comments on the previous post Tom said this was circular reasoning. A good example of circular reasoning is:

"The Bible is the Word of God because God tells us it is... in the Bible."

In the above the reasoning is circular. If the Bible is the word of God, then in the Bible God tells you so. But if it was not the word of God, then God did not say it was. It is not a good logical argument.

In a positive feedback phenomenon there is a feedback loop made up of real things. It is not just circular reasoning. You can watch and measure what is going on in the real world. You can see how one part pushes another, and that pushes so that it comes back around magnifying the phenomenon.

I think it will help readers to understand my examples of positive feedback loops below, and their common characteristics, before looking at hyperinflation:

Avalanche

A bunch of snow can be sitting on a steep mountain so that it is almost ready to slide. If something, say a little rabbit, then causes some of it to move, then that can cause more, which causes more, etc. A small trigger can set off a chain reaction that causes a huge amount of snow to slide down the mountain.

Forest Fire

If there is a high enough density of burnable material in the forest, then a single ignition can set off a chain reaction where a whole forest burns down.

Earthquake

There are two plates of earth touching each other. But they are slowly pushing past each other. For many years the ground just slightly flexes under the strain. However, at some point part of the ground rips. After the first part rips the strain is too much for the next part and it also rips. This chain reaction continues down the fault line often for miles.

Volcano

Water is mixed in the lava but under such pressure that it does not turn into steam even though it is very hot. However, if some of the lava on top breaks through the earth dam around the lava and spills out then there is less pressure on the lava below. If there is enough less pressure that the water turns to steam it can throw off the top of the lava. This then reduces the pressure on the lava further below which then also releases steam. This chain reaction can continue till huge quantities of lava are thrown into the air as volcanic ash. From space you can see the ash and water vapor after an eruption.

Hurricane

If the ocean is over 82 degrees F and the ocean is hotter than the air then it can warm up the air as wind blows over he ocean. The hotter air rises and makes more wind. The faster the wind goes the more heat is transferred from the ocean to the air.

The more heat there is in the air, the faster the wind blows. So you get a positive feedback loop leading to really strong winds.

Domino Avalanche

Set up dominoes so that the first one will knock over 2 others, and each of those will knock over 2 more, etc. So with each time increment there will be twice as many dominoes falling. One little push can then cause many dominoes to fall over.

Landslide

This is much like an avalanche but earth instead of snow. There is a bunch of earth on a slope and once some of it starts to break more and more follows till there is lots of earth sliding down.

Earth Dam Failure

If a little bit of water goes over or through an earth dam it can erode a bit of the dam. This makes for a bigger path for water and so water flows faster. This then removes earth faster and so water flows faster and faster. With this positive feedback loop, an earth dam can be quickly destroyed.

Snowball

With the right hill and snow you can start a small snowball rolling down the hill and it will grow and grow and grow till it gets to the bottom of the hill.

Ping Pong Balls and Mousetraps

If you put a bunch of ping pong balls on set mousetraps and trigger one, you can get a chain reaction. It only takes a small amount of energy to trigger a mousetrap and then the ball flies off with lots of energy to bounce around and hit others. This is not part of nature, but the video is fun and does illustrate the idea of a chain reaction.

Common Characteristics for these and Hyperinflation

In each case there is some set up condition. Something that has to be in place for a growing chain reaction to be possible. Under the right conditions, a small thing can set off a large chain reaction. Once the chain reaction starts it is very hard to stop it. Eventually it will burn itself out and stop on its own. Under the "proper conditions", we say there is a risk of this chain reaction. Even if the reaction has not yet happened, an expert can still see that there is a risk of it happening.

Because a small input can move things to another state, the initial state can be viewed as unstable. We also tend to see positive feedback loops as causing destruction.

The positive feedback loops above have some form of stored energy which is used up in powering the chain reaction. The stored energies above are gravitational potential energy, chemical energy, heat energy, or elastic potential energy. I think the equivalent in hyperinflation is the total value of all the currency and bonds in that currency being used up.

The best prediction you can give for most of these is "a high risk" and not an exact date. Earthquakes, volcanoes, forest fires, avalanches, etc. are things where an expert can tell when there is a danger, but still not be able to say exactly when the trigger will be. I think it is the same with hyperinflation.

It would make as much sense to accuse each of these real world phenomenon of circular reasoning as it does to claim this of my explanation of hyperinflation.

Now on to Hyperinflation

Once you understand the above examples of positive feedback loops you should then read the different ways of explaining the positive feedback loops in hyperinflation.

Tuesday, August 12, 2014

Lack of avalanche does not prove lack of risk of avalanche

Hyperinflation is like an avalanche, forest fire, earthquake, or volcano eruption.

Conditions for a chain reaction build up and then things happen fast.

But the build up time can be very long. It is not really possible to predict exactly when the chain reaction will start. The best you can do is say that conditions

for the chain reaction are such that there is a high risk. Certain types of things can transition from stable to destruction very quickly with very little provocation.

If conditions are right, a small rabbit jumping across the snow could set off a huge avalanche. Conditions in Japan are such that some small event could trigger hyperinflation at any time. Maybe China sinking a Japanese boat or a pension fund getting out of JGBs. We don't know what the equivalent of the rabbit will be for Japanese hyperinflation, but we can tell Japan has the setup for this type of chain reaction.

Again and again there are blog posts where people say the fact that Japan or the USA has not had hyperinflation so far proves that the theories saying there is a risk of hyperinflation are wrong. This is just not true. That an avalanche has not happened yet is in no way proof that there is no risk of avalanche. Such logic is flawed. It ignores the fast moving chain reaction that is fundamental to the nature of the problem. The same is true for hyperinflation. That it has not happened yet does not in any way prove that there is not a high risk of hyperinflation. Many countries went from normal inflation to hyperinflation rather quickly.

I have yet to have any really strong logical attack on my hyperinflation explained or hyperinflation faq posts. More than 100 times I have tried to engage other bloggers posting about hyperinflation.

The lack of any serious intellectual challenge to my "positive feedback theory of hyperinflation" is more of a confirmation of my theory than the lack of hyperinflation in Japan or the USA is any sort of refutation.

Cnningham's Law says, "the best way to get the right answer on the Internet is not to ask a question, it's to post the wrong answer.". If I was wrong, I really think someone would have been able to point this out by now.

The xkcd Duty Calls sort of sums this up:

I think it is safe to say there is nothing obviously wrong with my theory of hyperinflation.

Dear reader, if you think there is anyone that could refute my theory of hyperinflation please send them a link to this post.

If conditions are right, a small rabbit jumping across the snow could set off a huge avalanche. Conditions in Japan are such that some small event could trigger hyperinflation at any time. Maybe China sinking a Japanese boat or a pension fund getting out of JGBs. We don't know what the equivalent of the rabbit will be for Japanese hyperinflation, but we can tell Japan has the setup for this type of chain reaction.

Again and again there are blog posts where people say the fact that Japan or the USA has not had hyperinflation so far proves that the theories saying there is a risk of hyperinflation are wrong. This is just not true. That an avalanche has not happened yet is in no way proof that there is no risk of avalanche. Such logic is flawed. It ignores the fast moving chain reaction that is fundamental to the nature of the problem. The same is true for hyperinflation. That it has not happened yet does not in any way prove that there is not a high risk of hyperinflation. Many countries went from normal inflation to hyperinflation rather quickly.

I have yet to have any really strong logical attack on my hyperinflation explained or hyperinflation faq posts. More than 100 times I have tried to engage other bloggers posting about hyperinflation.

The lack of any serious intellectual challenge to my "positive feedback theory of hyperinflation" is more of a confirmation of my theory than the lack of hyperinflation in Japan or the USA is any sort of refutation.

Cnningham's Law says, "the best way to get the right answer on the Internet is not to ask a question, it's to post the wrong answer.". If I was wrong, I really think someone would have been able to point this out by now.

The xkcd Duty Calls sort of sums this up:

I think it is safe to say there is nothing obviously wrong with my theory of hyperinflation.

Dear reader, if you think there is anyone that could refute my theory of hyperinflation please send them a link to this post.

Tuesday, July 15, 2014

Spontaneous Combustion Theory of Inflation

There have been many posts trying to ridicule the Spontaneous Combustion Theory of Inflation. The name is to make it seem ridiculous that inflation could just suddenly take off. However, in the real world hyperinflation does just suddenly take off. There is good theory as to how inflation suddenly takes off. Making a silly name for something is a debating technique but it is not a sound logical argument. Hyperinflation is a real thing.

Saturday, July 5, 2014

Article on Hyperinflation in Japan

I think the article Deflation, Quantitative Easing and Hyperinflation in Japan: How Abenomics will Destroy a Proud and Successful Nation is well worth reading.

Friday, April 11, 2014

Problem with central banks making it up as they go along

I highly recommend this speech that Dallas Fed President and FOMC voting member Richard Fisher gave in Hong Kong. I think he does a good job of explaining the reality of central banking. It really boils down to making it up as they go along.

The problem with this is the risk of getting sucked into a hyperinflation feedback loop. If you are wondering around and making things up as you go along, and happen to step into the hyperinflation death spiral, you will not be able to just step back out.

The politicians, with their large debt and deficit spending, are really a key part of the setup for hyperinflation. I think the politicians and central bankers do not yet understand hyperinflation well enough to take the difficult choices needed to avoid stepping into the hyperinflation trap.

Wednesday, March 19, 2014

Living Like Parasites

Putin said of America, "They are living like parasites off the global economy and their monopoly of the dollar."

Putin understands something that few do.

Imagine half the dollars are outside the USA and half are in. Then imagine $1 trillion new dollars are made and owned by the USA. No real new value is made when this new $1 trillion in money is created. Eventually all the existing money will be reduced in value because of this new money. Half of this stolen value comes from reducing the value of the money outside the USA. So in effect the USA has sucked $500 billion out of the rest of the world. Living like parasites is a good description.

Sunday, March 9, 2014

The Threat of Dumping Bonds

When the British, French, and Israelis attacked in the 1957 Suez Crisis, America was able to put financial pressure on Britain. It held many British bonds and threatened to start selling them if the British did not stop the attack. From the Wikipedia article:

"Britain's then Chancellor of the Exchequer, Harold Macmillan, advised his Prime Minister Anthony Eden that the United States was fully prepared to carry out this threat. He also warned his Prime Minister that Britain's foreign exchange reserves simply could not sustain a devaluation of the pound that would come after the United States' actions; and that within weeks of such a move, the country would be unable to import the food and energy supplies needed simply to sustain the population on the islands."

Some say this marked the end of the British imperial power and the start of America as a "superpower".

Now Russia is threatening to dump US bonds if the US imposes sanctions on Russia for Crimea.

Hum.

Friday, March 7, 2014

Scientific Theories Make Testable Predictions

A common criticism of "people who believe in hyperinflation" (as if it was like the Tooth Fairy) is that we can not reliably say when it will start. You can see this at Cullen Roche, Scott Sumner, Mike (Mish) Shedlock, and Paul Krugman. Several of these have had many posts of the form, "ha, ha, I have been right so far". However, I have not been able to any real debate from these people over the theory of hyperinflation as in Hyperinflation FAQ and also Hyperinflation Explained in Many Different Ways.

The average paper money seems to last about 25 years. Big developed countries pull this average up, but even America has had hyperinflation a couple of times. But for discussion, lets assume hyperinflation happens 1 out of every 25 years in the average country. This means that 24 out of 25 years there is no hyperinflation. Someone who just says, "no hyperinflation this year" is like a stopped clock that is right 96% of the time. And still they are so proud. :-)

Just to be very clear, if these people don't switch to "there will be hyperinflation this year" right before the hyperinflation starts, then I claim that in all their previous predictions of "no hyperinflation this year", they were just being stopped clocks.

I also like to point out that when you go from 2% inflation to 26% inflation, 30 year bonds will lose 99% of their real value. So it is better to be many years early than one year late in getting out of bonds if hyperinflation is coming.

Still, there is some truth to this criticism. A scientific theory makes testable predictions. A good theory should make predictions that turn out right. Not looking to debate if The Dismal Science is a real science.

With my many explanations of hyperinflation we have many good theories of how hyperinflation works. In general there is a feedback loop. But most of these theories don't give us much clue about when the feedback loop will start. The timing is not really part of these theories.

However, one of these does have timing information. The backing theory of hyperinflation. This says that the central bank has to have reserves to support the value of the currency. If the central bank is burning through these reserves at a rate where they run out after a certain time, we have some handle on the timing. They may prop up the value of their currency till they are almost out of reserves, but that is it. There will be a day of reckoning. We can estimate when by how long till they run out of reserves.

When the Argentine government took much of their central bank's reserves, I said to myself that they were headed for hyperinflation. A reader of this blog pointed out that the Ukraine's central bank did not have enough backing and so seemed headed for hyperinflation. Both of these were based on the backing theory of hyperinflation. So to me the backing theory of hyperinflation seems a very good way to predict timing for hyperinflation. So I would like to try to do this in a public way. Clearly predictions made in public are far more impressive.

For me the interesting prediction is when a currency will go from something normal like 2% inflation to 26% or higher yearly inflation. There are also many more making this transition than those that go all the way to 50% per month.

Do any readers have an ideas for countries that now have moderate inflation but where the central bank reserves per note issued are far below the current value of the note? A government running a big deficit has a harder time bailing out the central bank, so that is an important factor as well. In fact, it is prbably reasonable to just look at foreign reserves if the government has a large deficit, ignoring government bonds.

I will update this post trying to make an ordered list of hyperinflation candidates.

The central banks in the big reserve currency countries seem to have lots of long term bonds in their own currency. It would be nice to know how much these would drop in value as interest rates went up. Like if Japan's interest rates go up 2% what does that do to the value of the central bank's reserves?

I have an earlier post on ideas for predicting the timing of hyperinflation.

The average paper money seems to last about 25 years. Big developed countries pull this average up, but even America has had hyperinflation a couple of times. But for discussion, lets assume hyperinflation happens 1 out of every 25 years in the average country. This means that 24 out of 25 years there is no hyperinflation. Someone who just says, "no hyperinflation this year" is like a stopped clock that is right 96% of the time. And still they are so proud. :-)

Just to be very clear, if these people don't switch to "there will be hyperinflation this year" right before the hyperinflation starts, then I claim that in all their previous predictions of "no hyperinflation this year", they were just being stopped clocks.

I also like to point out that when you go from 2% inflation to 26% inflation, 30 year bonds will lose 99% of their real value. So it is better to be many years early than one year late in getting out of bonds if hyperinflation is coming.

Still, there is some truth to this criticism. A scientific theory makes testable predictions. A good theory should make predictions that turn out right. Not looking to debate if The Dismal Science is a real science.

With my many explanations of hyperinflation we have many good theories of how hyperinflation works. In general there is a feedback loop. But most of these theories don't give us much clue about when the feedback loop will start. The timing is not really part of these theories.

However, one of these does have timing information. The backing theory of hyperinflation. This says that the central bank has to have reserves to support the value of the currency. If the central bank is burning through these reserves at a rate where they run out after a certain time, we have some handle on the timing. They may prop up the value of their currency till they are almost out of reserves, but that is it. There will be a day of reckoning. We can estimate when by how long till they run out of reserves.

When the Argentine government took much of their central bank's reserves, I said to myself that they were headed for hyperinflation. A reader of this blog pointed out that the Ukraine's central bank did not have enough backing and so seemed headed for hyperinflation. Both of these were based on the backing theory of hyperinflation. So to me the backing theory of hyperinflation seems a very good way to predict timing for hyperinflation. So I would like to try to do this in a public way. Clearly predictions made in public are far more impressive.

For me the interesting prediction is when a currency will go from something normal like 2% inflation to 26% or higher yearly inflation. There are also many more making this transition than those that go all the way to 50% per month.

Do any readers have an ideas for countries that now have moderate inflation but where the central bank reserves per note issued are far below the current value of the note? A government running a big deficit has a harder time bailing out the central bank, so that is an important factor as well. In fact, it is prbably reasonable to just look at foreign reserves if the government has a large deficit, ignoring government bonds.

I will update this post trying to make an ordered list of hyperinflation candidates.

The central banks in the big reserve currency countries seem to have lots of long term bonds in their own currency. It would be nice to know how much these would drop in value as interest rates went up. Like if Japan's interest rates go up 2% what does that do to the value of the central bank's reserves?

I have an earlier post on ideas for predicting the timing of hyperinflation.

Thursday, February 13, 2014

Preventing Crises

If since the USA was founded they had required banks to sell 10 year bonds to

get the cash to use for 10 year loans (banks can't use demand deposits, must have

matched duration bonds and loans, so no fractional reserve banking or "bank made money") and never

went off a gold/silver coin money (no paper money or central bank) then I

think that there would not have been anywhere near the number of

inflations/booms/busts/deflations/financial-crises between then and now. If

regular banks and central banks can increase or decrease the money supply, then the

money supply is not stable, and you get booms and busts and crisis after crisis.

This is sort of my version of the Austrian Business Cycle Theory. I think it is easier to think about in terms of central bank made money and private bank made money not being stable, so nothing is. Fractional reserve banking is the core cause of financial crises and the reason people think they need a central bank to act as a lender of last resort. If you did not have fractional reserve banking, then you would not need a central bank and could have a much more stable money supply and financial system.

For more than 2,000 years an ounce of gold has been about the value of a nice suit, shoes, and belt. This is amazing stability. The median life expectancy for defunct paper currencies is only 15 years. Even in the big stable countries paper money loses more than 90% of its value in under 100 years. In the 1950s a silver dime was about the value of a gallon of gas and 1/10th of an ounce of silver is still around the value of a gallon of gas but the US dollar does not buy anywhere near as much gas it could 60 years ago. Paper money does not come close to the stability of gold and silver. Paper money and fractional reserve banking together is a recipe for financial disaster.

Keynesians think that if we just make more money we could avoid the pain of the bust. However, this can lead to hyperinflation and far more pain. I think it is much better to understand the cause for the boom and bust and how to avoid these.

This post comes from a conversation with Tom that deserves its own post and thread.

This is sort of my version of the Austrian Business Cycle Theory. I think it is easier to think about in terms of central bank made money and private bank made money not being stable, so nothing is. Fractional reserve banking is the core cause of financial crises and the reason people think they need a central bank to act as a lender of last resort. If you did not have fractional reserve banking, then you would not need a central bank and could have a much more stable money supply and financial system.

For more than 2,000 years an ounce of gold has been about the value of a nice suit, shoes, and belt. This is amazing stability. The median life expectancy for defunct paper currencies is only 15 years. Even in the big stable countries paper money loses more than 90% of its value in under 100 years. In the 1950s a silver dime was about the value of a gallon of gas and 1/10th of an ounce of silver is still around the value of a gallon of gas but the US dollar does not buy anywhere near as much gas it could 60 years ago. Paper money does not come close to the stability of gold and silver. Paper money and fractional reserve banking together is a recipe for financial disaster.

Keynesians think that if we just make more money we could avoid the pain of the bust. However, this can lead to hyperinflation and far more pain. I think it is much better to understand the cause for the boom and bust and how to avoid these.

This post comes from a conversation with Tom that deserves its own post and thread.

Monday, February 3, 2014

Phillips Curve Fallacy

There is a good article in Forbes about the Phillips curve fallacy that most economists seem to operate under.

Phillips studied wages under a gold standard and found that when labor was in tight supply that wages went up. This is just saying that when supply is tight the price goes up. This is basic economics and common sense.

But most modern economists take this study and think that if they print money that employment will go up. This study does not show that at all.

Monday, January 20, 2014

Three points for Cullen

Cullen has agreed to respond to 3 of my points of my choosing. So here they are.

1) In Hyperinflation Explained in Many Different Ways I would like him to respond to the section, Modern Monetary Theory and Monetary Realism.

2) In my Hyperinflation FAQ, the comment, "Can't we wait till there are signs of inflation before doing anything?".

3) In my Hyperinflation FAQ, the comment, "How is hyperinflation stopped?".

Answer

Cullen replied here. Thanks Cullen!

Vince

Cullen, if you are rejecting the MMT view that government bonds are part of the money supply then how can you logically keep their claim that when the central bank makes new money and buys up bonds that it is “just an asset swap”. Their logic was that if bonds are already money then swapping for money does not change the quantity of money. If bonds are not money then making new money and buying bonds is “monetization”, replacing government debt with money. So if you reject their view on bonds, how can you keep saying it is “just an asset swap”?

Cullen, I really meant for you to respond to my answers for the FAQ questions, not just the questions themselves.

Cullen

Vince

In my FAQ the parts that I wrote are the answers. So to respond to me should have been responding to my answers. Instead Cullen just looked at the questions. I called him on it and he ignored me.

He answered part 1 but when I point out a logical flaw in his position he does not address it and says, "I am pretty busy today so maybe another time". Cullen then responds to 7 other comments in that thread. I call BS. Cullen is not really debating with me.

Tuesday, January 14, 2014

The Peg Route to Hyperinflation

I got an email from Alexey Eromenko pointing out that I really sort of ignore another common way to hyperinflation.

If a central bank is trying to peg the local currency to a foreign currency even while printing new money they can lose too much of their reserves and not be able to hold the peg. At this point the currency can suddenly crash and they can get hyperinflation.

In general I am focused on Japan, the UK, and the USA. These countries are big and seem headed for hyperinflation. These guys don't peg to anyone else, so I have not thought about it much.

However, Alexey is correct that a currency peg has been an issue in some case. In Argentina's case the government basically stole the reserves of the central bank. Using the Real Bills view of hyperinflation, we can see that this, or even losing all your reserves trying to defend a peg, should lead to hyperinflation.

I suspect that it is going to turn out to be true that much of the time this happens the government was running a large debt and deficit. So the central bank was trying to help out the government with new money, but then ran into trouble defending the peg. So in some sense it is very similar in origin to others. If a central bank is running a proper currency board they would always be able to defend a peg to the other currency.

But my idea of the typical start to hyperinflation is the central bank monetizing bonds and people fleeing bonds. The central bank has to keep buying bonds because the government has a huge deficit and needs cash to operate, so there is a huge flood of new money. The peg route to hyperinflation is different from this. Something worth keeping in mind.

Thanks Alexey!

If a central bank is trying to peg the local currency to a foreign currency even while printing new money they can lose too much of their reserves and not be able to hold the peg. At this point the currency can suddenly crash and they can get hyperinflation.

In general I am focused on Japan, the UK, and the USA. These countries are big and seem headed for hyperinflation. These guys don't peg to anyone else, so I have not thought about it much.

However, Alexey is correct that a currency peg has been an issue in some case. In Argentina's case the government basically stole the reserves of the central bank. Using the Real Bills view of hyperinflation, we can see that this, or even losing all your reserves trying to defend a peg, should lead to hyperinflation.

I suspect that it is going to turn out to be true that much of the time this happens the government was running a large debt and deficit. So the central bank was trying to help out the government with new money, but then ran into trouble defending the peg. So in some sense it is very similar in origin to others. If a central bank is running a proper currency board they would always be able to defend a peg to the other currency.

But my idea of the typical start to hyperinflation is the central bank monetizing bonds and people fleeing bonds. The central bank has to keep buying bonds because the government has a huge deficit and needs cash to operate, so there is a huge flood of new money. The peg route to hyperinflation is different from this. Something worth keeping in mind.

Thanks Alexey!

Dangerous to back your currency with the future value of your currency

One of my many explanations of hyperinflation is the Backing View or Real Bills Doctrine. This says that the central bank has to have assets that it can use to withdraw the notes it issues to support the value of those notes. It also warns any bonds should be short term, like 60 days or less.

The Fed owns 40% of all treasuries over 5 years in maturity. About $3 trillion of the $4 trillion in assets the Fed owns are more than 5 years. This means that the Fed is using long term bonds, against the advice of the Real Bills Doctrine. The reason this is a problem is that it ends up backing the current value of the notes with the future value of the notes. If interest rates are going up the value of the bonds will go down and so the backing of the current notes becomes worth less and less. But the more the value of the current notes drops, the less the long term bonds will be worth also. This can spiral out of control.

The Fed is backing the dollar with the future value of the dollar. If this starts to go bad it can go really bad.

Saturday, January 11, 2014

Mish needs to understand what is happening during hyperinflation

Again this week Mish was ridiculing hyperinflation with words like "stupid", "foolish", and "preposterous".

However, Mish really only looks at the setup for and the after effects of hyperinflation. He never looks directly at hyperinflation. He understands that the core problems leading up to hyperinflation are political in nature. However, this is the setup, before hyperinflation starts. He understands that it usually ends in the destruction of the currency, or a "complete loss of faith in the currency". But this is after hyperinflation has ended. There can be many years between the setup and the after effects, and this is the time that is really called "hyperinflation". He has yet to focus on what is going on in the actual hyperinflation period.

The core political problem always results in the government deficit spending, a large debt, and the central bank monetizing the debt. Monetizing debt is a monetary phenomenon. Another key issue is that the velocity of money always increases at the start of hyperinflation and this helps make prices go up. Quantity of money and velocity of money are monetary phenomenon. Mish is clearly wrong when he says, "hyperinflation is not a monetary phenomenon".

I think it is fundamentally wrong for anyone to say there is no risk of hyperinflation without first describing their theory of how hyperinflation works.

I have more than 30 different ways of explaining the interesting process of hyperinflation that Mish skips over. I also have a Hyperinflation FAQ that counters Mish's arguments. I dearly wish that Mish would look at the actual process of hyperinflation.

Wednesday, January 1, 2014

How We Know High Inflation is Coming

There have been many econoblog posts of the form, "ha, ha, the people predicting inflation have been wrong so far, when will they give up?". Let me try to explain why we know high inflation is coming eventually.

The equation of exchange shows the relationship between the money supply, velocity of money, price level, and real GNP. This equation is a tautology that no competent economist would argue against.

Money-supply * Velocity-of-money = Price-level * Real-GNP

On the scale that we are currently increasing the money supply, the real GNP is basically constant. Inflation can be thought of as too much money chasing too few goods. When looking at a 400% change in the base money supply over the last 5 years, the change in real GNP (change in goods) is so small that we won't be off much by ignoring it. To help understand this short period of time with a big change in the base money supply, we can make a simplified version of the equation of exchange.

Money-supply * Velocity-of-money = Price-level * constant

If the velocity goes down as the money supply goes up, it is possible to increase the money supply without changing the price level.

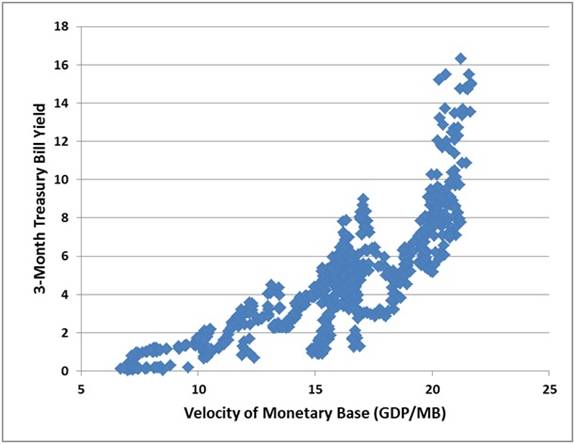

Hussman has shown that as interest rates go down the velocity of money goes down and as interest rates go up the velocity of money goes up.

At first when the Fed makes new money and buys bonds, they increase the price of bonds, which means they lower the interest rate. Hussman's data shows this lowers the velocity of money. The lower velocity can compensate for the increased quantity of money so that often new money does not cause inflation right away.

The equation of exchange can be used with whichever definition of money supply you want to use (base money, M1, M2, etc). It is most clear that inflation will come if we use base money as our definition of the money supply. The base money supply has gone up by around a factor of 4 in about 5 years.

Since we have so far avoided inflation, the velocity of base money must have gone down by about a factor of 4 during this same period. The way this happened is that most of the new base money the Fed has made has just sat still in the Fed as excess reserves. This huge amount of non-moving money lowers the overall average velocity of money. If you think about it, it makes sense that making new money that does not leave the Fed should not cause inflation. Paying higher interest on excess reserves than short term bonds were paying was Bernanke's great new trick to hide a few trillion dollars out in the open.

However, now interest rates are going up. From Hussman we should now expect the velocity of money to go up. From the simplified equation of exchange, when the velocity of money and the money supply are both going up we should expect inflation.

As interest rates return to normal levels, the velocity of money will also return to normal levels. Then we will have 4 times the money supply and a normal velocity of money. By the simplified equation of exchange, we will then have 4 times the price level. We will have very high inflation.

You may be wondering, "why can't the Fed hold interest rates down forever?". Good question. If inflation is higher than the interest rate, then everyone and their brother can make money by borrowing and buying random stuff. To hold rates down the Fed would have to make an ever increasing amount of money, resulting in ever increasing inflation and ever increasing borrowing. The Fed seems interested in tapering their money creation which will mean letting interest rates go up. Japan, at least for the moment, seems to have chosen to try to hold interest rates down no matter how much money creation it takes. Once government debt and deficit are out of control, there is no good path for the central bank.

For the velocity of money to return to normal, it is reasonable to expect the excess reserves at the Fed will enter the real economy. There are those who think these excess reserves are somehow trapped but a bank with excess reserves can send an armored truck to the Fed and withdraw paper Federal Reserve Notes with no restrictions on them. This could happen at any time and possibly very suddenly. A couple trillion dollars suddenly flowing into the real economy would clearly result in high inflation.

Even Krugman has said that increasing the money supply is only safe when interest rates are near the zero lower bound. With interest rates going up, even by Krugman's logic, we should expect inflation.

Here is another way to look at it. From 1913 to 2007 the Fed made about $800 billion in new money total. Since then it makes around that much each year. Nearly 94 years worth of money every 12 months. In this environment, one should expect to see "too much money chasing too few goods".

Another way to look at it. In order to not cause inflation the central bank would need to be able to withdraw all the new money they created. There is just no way this can happen. Interest rates would shoot up, the value of the bonds the Fed held would crash, and they could not sell them for enough to withdraw as much money as they created.

High inflation will come. It is just a question of when.

I will pay $100 US by paypal to the first person to comment below about a case where a central bank increased the monetary base by a factor of 4 or more by buying government bonds in 5 years or less and did not get at least double digit inflation sometime during that time or the 5 years after. Must provide links to reliable info on base money growth and subsequent inflation.

This has to be for an established central bank, not a new one or a new currency at an old one (currency and bank around for at least 10 years prior to 4x period). It must be expanding the monetary base by buying up government bonds for that country (like US, UK, and Japan are doing). I am looking for a situation where a central bank did something similar to what the US has done in the last 5 years but that did not get high inflation.

Note one round of this has been won as of 1/5/14 (see comments) but I had not specified that the 4x expansion had to be from monetization which is in the current rules.

The equation of exchange shows the relationship between the money supply, velocity of money, price level, and real GNP. This equation is a tautology that no competent economist would argue against.

Money-supply * Velocity-of-money = Price-level * Real-GNP

On the scale that we are currently increasing the money supply, the real GNP is basically constant. Inflation can be thought of as too much money chasing too few goods. When looking at a 400% change in the base money supply over the last 5 years, the change in real GNP (change in goods) is so small that we won't be off much by ignoring it. To help understand this short period of time with a big change in the base money supply, we can make a simplified version of the equation of exchange.

Money-supply * Velocity-of-money = Price-level * constant

If the velocity goes down as the money supply goes up, it is possible to increase the money supply without changing the price level.

Hussman has shown that as interest rates go down the velocity of money goes down and as interest rates go up the velocity of money goes up.

At first when the Fed makes new money and buys bonds, they increase the price of bonds, which means they lower the interest rate. Hussman's data shows this lowers the velocity of money. The lower velocity can compensate for the increased quantity of money so that often new money does not cause inflation right away.

The equation of exchange can be used with whichever definition of money supply you want to use (base money, M1, M2, etc). It is most clear that inflation will come if we use base money as our definition of the money supply. The base money supply has gone up by around a factor of 4 in about 5 years.

Since we have so far avoided inflation, the velocity of base money must have gone down by about a factor of 4 during this same period. The way this happened is that most of the new base money the Fed has made has just sat still in the Fed as excess reserves. This huge amount of non-moving money lowers the overall average velocity of money. If you think about it, it makes sense that making new money that does not leave the Fed should not cause inflation. Paying higher interest on excess reserves than short term bonds were paying was Bernanke's great new trick to hide a few trillion dollars out in the open.

However, now interest rates are going up. From Hussman we should now expect the velocity of money to go up. From the simplified equation of exchange, when the velocity of money and the money supply are both going up we should expect inflation.

As interest rates return to normal levels, the velocity of money will also return to normal levels. Then we will have 4 times the money supply and a normal velocity of money. By the simplified equation of exchange, we will then have 4 times the price level. We will have very high inflation.

You may be wondering, "why can't the Fed hold interest rates down forever?". Good question. If inflation is higher than the interest rate, then everyone and their brother can make money by borrowing and buying random stuff. To hold rates down the Fed would have to make an ever increasing amount of money, resulting in ever increasing inflation and ever increasing borrowing. The Fed seems interested in tapering their money creation which will mean letting interest rates go up. Japan, at least for the moment, seems to have chosen to try to hold interest rates down no matter how much money creation it takes. Once government debt and deficit are out of control, there is no good path for the central bank.

For the velocity of money to return to normal, it is reasonable to expect the excess reserves at the Fed will enter the real economy. There are those who think these excess reserves are somehow trapped but a bank with excess reserves can send an armored truck to the Fed and withdraw paper Federal Reserve Notes with no restrictions on them. This could happen at any time and possibly very suddenly. A couple trillion dollars suddenly flowing into the real economy would clearly result in high inflation.

Even Krugman has said that increasing the money supply is only safe when interest rates are near the zero lower bound. With interest rates going up, even by Krugman's logic, we should expect inflation.

Here is another way to look at it. From 1913 to 2007 the Fed made about $800 billion in new money total. Since then it makes around that much each year. Nearly 94 years worth of money every 12 months. In this environment, one should expect to see "too much money chasing too few goods".