The Equation of Exchange says:

where:

= Money supply

= Money supply = Velocity of money

= Velocity of money = Price level

= Price level = Real GNP

= Real GNP

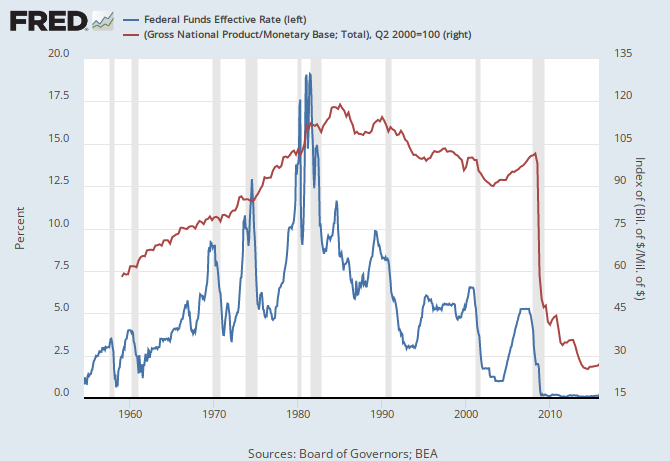

When you first introduce the punchbowl, as the Fed buys bonds or lends to banks cheaply the money supply goes up and the interest rates go down which makes the velocity of money also go down (as seen in the graph above). The lower velocity of money can largely compensate for the increased quantity of money so that the price level does not change too much. It seems like free money has no downside and the central bank has amazing powers.

- However, if you try to withdraw the punchbowl the interest rates also go up, increasing the velocity of money. This increased velocity of money compensates for the reduced money supply so you have the pain of higher interest rates but still get the inflation. It can seem like "inflation is out of control" and the central bank is powerless. This makes for a difficult time for a central bank. It can take a very strong leader and a recession to really get inflation under control.

However, the velocity of money can also go up because of inflation. So if they don't take the punchbowl away you can get inflation because of the increasing money supply and also from the increasing velocity of money. In bad cases this can develop a positive feedback loop and really get out of control.

- John Hussman has a graph showing how extreme the current conditions of low interest rates, high money supply, and low velocity of money are:

- Even a tiny move from 0.125% to 0.25% in the fed funds rate would imply a similar move in 3-month treasuries, which the above graph indicates will cause a large increase in the velocity of money. By the equation of exchange, a large increase in the velocity of money will increase the price level and inflation.

- Update: Jason Smith made a post responding to this one. There are interesting comments here and also on that post.

- Update 12/23/15: two more graphs:

- Graph with fed funds and velocity of monetary base:

-

- Graph with fed funds and velocity of monetary base less excess reserves. Better fit if we take out excess reserves. Lower interest rates lower velocity and higher raise velocity. Some lag though. I like this view of short term stuff better than Hussman's.

-

- Since I think excess reserves are really like government debt, and base money should be stuff that does not pay interest and so has a hot-potato effect, I think it is correct to subtract excess reserves from the base money when calculating velocity of money to compare to fed funds rate.

- Update 12/29/15:

- Tom Brown points out that all reserves earn interest and so are not really like interest free money. So I made another graph with all reserves subtracted:

-

Introducing the punchbowl is easy and removing it is difficult but keeping the punchbowl forever can be deadly.